Low inflation, low unemployment, high growth — this is the Philippines

Low inflation, low unemployment, high growth — this is the Philippines

February 13, 2024 | 12:02 am

My Cup of Liberty

By Bienvenido S. Oplas, Jr.

https://www.bworldonline.com/opinion/2024/02/13/575175/low-inflation-low-unemployment-high-growth-this-is-the-philippines/

Last week, the Philippine Statistics Authority (PSA) released two important monthly reports, on the country’s unemployment rate for December 2023, and the inflation rate for January 2024. They show really good results — unemployment is at a 19-year low, inflation at a three-year low. See these stories in BusinessWorld: “Inflation sharply drops to 3-year low” (Feb. 7), “Jobless rate hits record low in 2023” (Feb. 8).

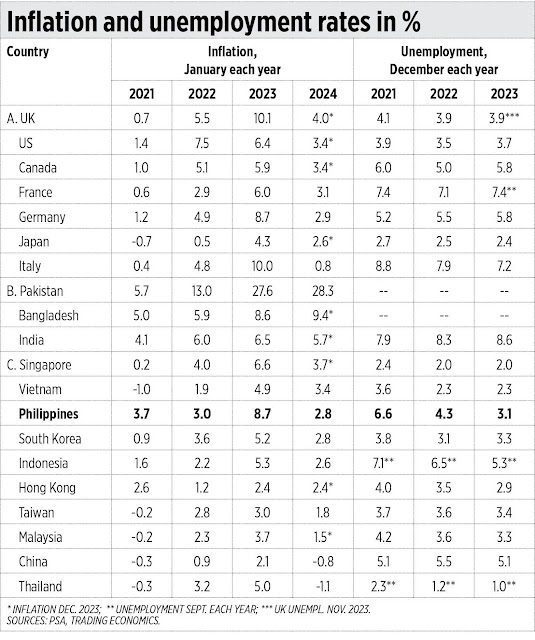

I am updating this column’s monthly monitoring of global and regional inflation and unemployment data. I have put together in Group A the G7 industrial countries, in Group B are the big South Asian nations, and in Group C are the big East Asian countries (see the table).

Budget Secretary Amenah F. Pangandaman has asserted again the optimistic trajectory of the Philippine economy, saying that “We are now in a low inflation, low unemployment, high growth path, the best situation that any economy can hope for. Our budget priorities will remain on improving both the hard and soft infrastructure for our people that will further raise their productivity, income and social well-being, their overall quality of life in the long term.”

Well said, Madam Secretary. In fact many G7 countries now have higher inflation than the Philippines — the UK, the US, Canada, France, and Germany. And the G7 unemployment rates are all higher than the Philippines’ except for Japan. High inflation, high unemployment, and low growth (even contraction in Germany) is the worst combination that any economy would wish to have.

One disturbing trend globally is that food inflation is higher than overall inflation. For instance, in January 2024, food inflation and overall inflation rates were, respectively: Germany, 4.2% and 2.9%; France, 5.7% and 3.1%; Italy, 5.9% and 0.8%; South Korea, 5.9% and 2.8%; Taiwan, 4.1% and 1.8%; Indonesia, 5.8% and 2.6%; and the Philippines, 3.5% and 2.8%.

These countries’ agriculture, climate, and energy policies have made big contributions to this ugly trend. Imposing high taxes on diesel (used by tractors, harvesters, trucks, irrigation pumps, fishing boats, etc.), for example, raises the cost of farming and transportation of produce. The Philippines’ diesel tax until 2017 was zero, then it became P6/liter after the TRAIN law of 2018 (RA 10963) was passed. And then there is land conversion from agriculture to solar farms.

Also last week, on Feb. 5, the Development Budget Coordination Committee (DBCC) held its first meeting this year, with new members Finance Secretary Ralph Recto and Special Assistant to the President for Investment and Economic Affairs Frederick Go, joining the old members, Economics Secretary Arsenio Balisacan, Budget Secretary Amenah Pangandaman, and the Bangko Sentral representative.

Secretary Recto postulated that economic targets should be revised towards more realistic levels and rates. See another story in BusinessWorld: “Growth, fiscal goals need to be ‘more realistic,’ says DoF chief” (Feb. 12).

Given the declining trend in growth globally, a mild reduction in the Philippines’ growth target, from 6.5%-7.5% to 6%-7%, is not a bad idea, to avoid future disappointment if targets are high and not attained a few months later.

There are three important policy measures that I think must be held and sustained.

One, control spending and limit public borrowings, from P2.2 trillion/year average in 2020-2023 to below P1.8 trillion/year in 2024-2028. This way, the target of reducing the Debt/GDP ratio, from 60% in 2023 to possibly 40% to 45% by 2028, has a higher chance of being attained.

Two, distortionary policies in agriculture and energy must be revisited if not reversed. This is to help reduce food inflation and, hence, overall inflation rates.

And three, avoid any new tax hikes in 2024 and possibly beyond. The Philippines’ current situation of high growth (3rd highest GDP growth in 2023 among the top 40 largest economies in the world), low inflation, and low unemployment (as discussed above) happened without any tax hikes.

On controlling spending, I want to mention that we should not entertain the lobby of the country’s defense establishment and their allies in media, academe, and think tanks, to purchase $36 billion (P2.016 trillion at P56/$) worth of military hardware (submarines, new battleships, missiles, and jetfighters). Excluded in their P2-trillion costly and impractical budget are spending for ammo, spare parts, and training. The Philippines should focus on diplomacy and negotiations, not war mongering.

And not only the military establishment but also the police, coast guard, and other agencies will be lobbying for their own trillions of pesos for additional acquisitions and manpower expansion. The Philippines may not prosper anymore as the agencies will just invent new spending, new borrowings, and new taxes.

If the military and various agencies push hard for their trillions of extra spending, one possible option is the massive, large-scale privatization of the land and assets of the Armed Forces of the Philippines, the Philippine National Police, and the Philippine Coast Guard. Use the proceeds of this privatization for their costly modernization, don’t pick the money from the taxpayers’ pockets.

Comments

Post a Comment