SONA 2023: investments, revenues and climate

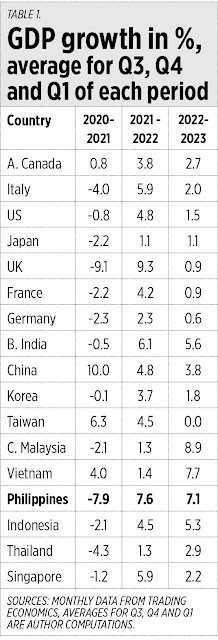

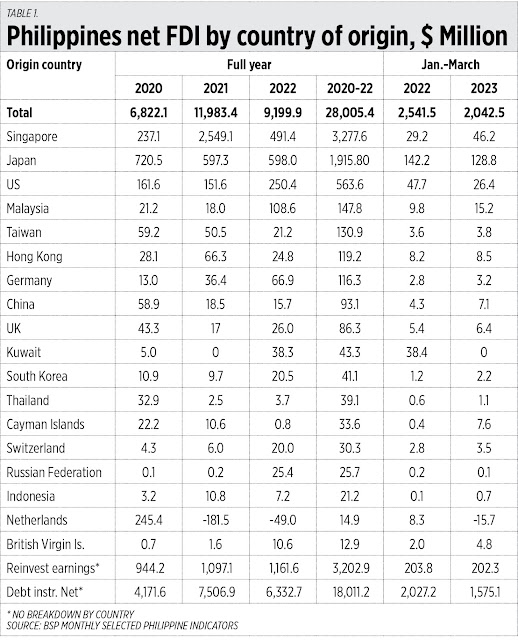

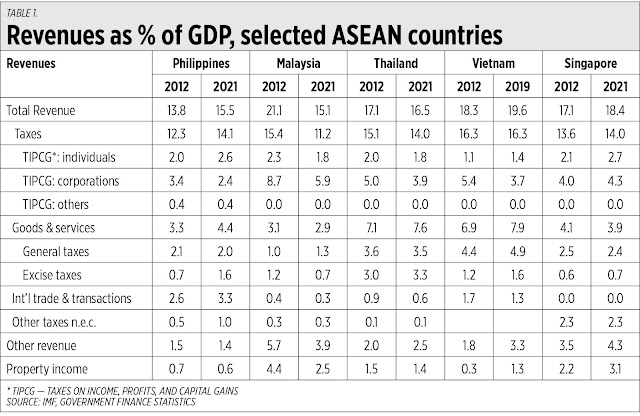

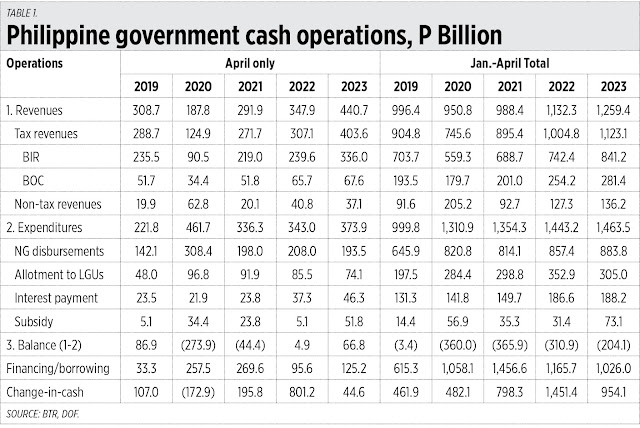

SONA 2023: investments, revenues and climate July 27, 2023 | 12:02 am My Cup Of Liberty By Bienvenido S. Oplas, Jr. https://www.bworldonline.com/opinion/2023/07/27/536090/sona-2023-investments-revenues-and-climate/ During his second State of the Nation Address (SONA) on Monday, July 24, President Ferdinand R. Marcos, Jr. highlighted economic recovery via high GDP growth, increasing the employment rate, investments, revenues, and spending on agriculture modernization; the decrease in inflation rate, other economic factors. For this piece, three subjects will be tackled — investments, revenues, and climate change. Note also that this month, this writer has made a four-part assessment of the economic performance of the administration’ first year: budget deficit and employment (part 1), inflation and interest rates (part 2), trade and investments (part 3), and overall GDP and agriculture (part 4). INVESTMENTS AND MAHARLIKA FUND The President said in his SONA, “For strategic financing, some