Growth recovery, declining births, and rising power demand

* My column in BusinessWorld last August 15.

--------------

This piece will cover six topics and events that occurred last week so we go straight to them.

1. GROWTH RECOVERY AND RISING INFLATION

Last week, the Philippine Statistics Authority (PSA) released the 2nd quarter (Q2) 2022 GDP growth and it was 7.4%, a bit lower than the Q1 growth of 8.2%. The PSA also released the July 2022 inflation rate last week and it was 6.4%, a bit higher than June’s inflation of 6.1%.

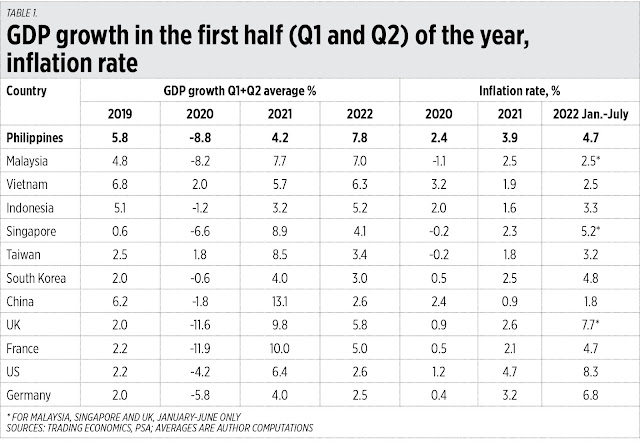

So, for Table 1, I averaged the GDP growth for Q1 and Q2 of selected countries and compared them with the Philippines’. Then I also averaged the inflation rate from January to July. The big East Asian economies with no Q2 GDP report yet, like Japan and Thailand, are not included in the table.

The Philippines so far has the fastest growth recovery in first half 2022 with 7.8%, followed by Malaysia and Vietnam. The main explanation is low base effect — the Philippines had the deepest GDP contraction in Asia in 2020, followed by low growth in 2021, so high growth in 2022 is just trying to recover and slightly surpass the 2019 GDP size and level.

The Philippines inflation for January-July is 4.7%, within the inflation target of 4.5%-5.5% set by the Development Budget Coordination Committee (DBCC) or the economic team (Table 1). If GDP growth in the second half of 2022 is sustained at 7-8%, this column projects a full year inflation of 5-5.2%.

The DBCC growth target of 6.5%-7.5% in 2022 is attainable — and we will likely surpass it. The growth target from 2023-2028 of 6.5%-8% is also attainable and something that we should work collectively for. Fast growth automatically tempers inflation via a higher supply of goods and services in the economy.

Notice Europe and the US, their deep contraction in 2020 and anemic growth after, coupled with high inflation this year. Stagflation is becoming more real for them. Many businesses there will consider migrating to Asia, including the Philippines.

The Philippines just enacted many market-oriented reforms: the corporate income tax cut under the CREATE law, the liberalization of the Public Service Act, the Foreign Investment Act, the Retail Trade Liberalization Act, dynamic Public Private Partnership (PPP), and there are no planned major tax hikes on the horizon. These are good attractions for those foreign businesses to come in, and for those already here to stay put....

6. SUGAR IMPORTATION AND FREE TRADE

I am from Cadiz City, Negros Occidental and whenever I go back home, I am still fascinated by the wide sugar farms that stretch from the highway to the mountains. But there are also huge land conversions from sugar to commercial-residential.

The new Silay-Bacolod airport, with its long runway and wide access roads and the diversion roads, were previously sugar farms. The large Ayala subdivision in Talisay and other new big subdivisions in the province were once sugar farms.

With declining hectarage, domestic sugar output is either flat-lining or declining while demand keeps rising. We should have free trade in sugar, and there should have been no scandal over sugar importation because it is something that we should do yearly to protect consumers.

Comments

Post a Comment